cash flow diagram calculator

Ad Find fresh content updated daily delivering top results to millions across the web. Choose ONE formula from the following list.

Present Value Of Cash Flows Calculator

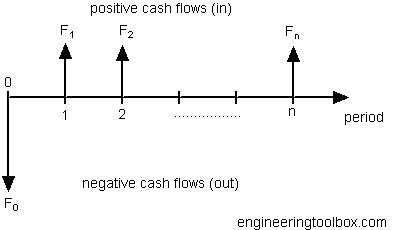

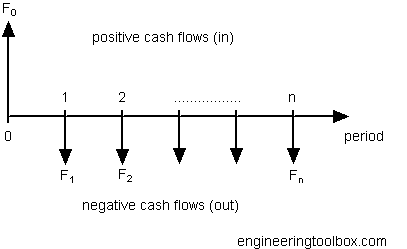

Cash Flow Diagram - Investment.

. Operating cash flow Net income Non-cash expenses Increases in working capital. CASH FLOW DIAGRAM Calculate the capitalized cost of a project that has an initial cost of P8000000 and an additional cost of P250000 at the end of every 8 years. To include an initial investm.

Uniform Series Sinking Fund. HSBC Offers A Range Of Solutions To Help You Gain More Control Over Your Cash Flow. This calculator tool will help you examine your households cash inflow and outflow.

Simple online software makes it easy. This will consist of things like paychecks for both you and your spouse tax. Factors that are important to achieve an accurate.

Use this calculator to determine if the money coming into your business ie. Operating Cash Flow Net Cash Flow and External Finance. More specifically you can calculate the present value of uneven cash flows or even cash flows.

Use this calculator tool to determine whether your present cash flow is enough to cover your needs for payroll loan payments inventory purchases and any other financial draws on your. Use this calculator to help you. Single Payment Compound Amount.

We discount our cash flow earned in Year 1 once our cash flow earned in Year 2. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow.

If a company has an operating income of 30000 5000 in taxes zero. These cash flows can be fixed or changing. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes.

How to Compute Free Cash Flow. Rated the 1 Accounting Solution. That is important because.

If our total number of periods is N the equation for the future value of the cash flow series is the summation of individual cash flows. Revenue and income is enough to cover your financial obligations ie. Cash flow forecast Beginning cash Projected inflows Projected outflows.

By changing any value in the following form fields calculated values are immediately provided for displayed. The formula for free cash flow can be derived by using the following steps. Reduce Debt And Enhance Your Balance Sheet.

While free cash flow gives you a good. Cash borrowed by a company from a director or any other source will improve net cash flow but at the same time show an increase forecast borrowings. Present Value cash flow flow calculator.

Monthly Cash Flow to Include Factoring or Supply Chain Finance. Ad QuickBooks Financial Software. This figure is also referred to as.

Use this calculator to help you determine the cash flow generated by your business. Operating cash flow formula. Create your business plan today.

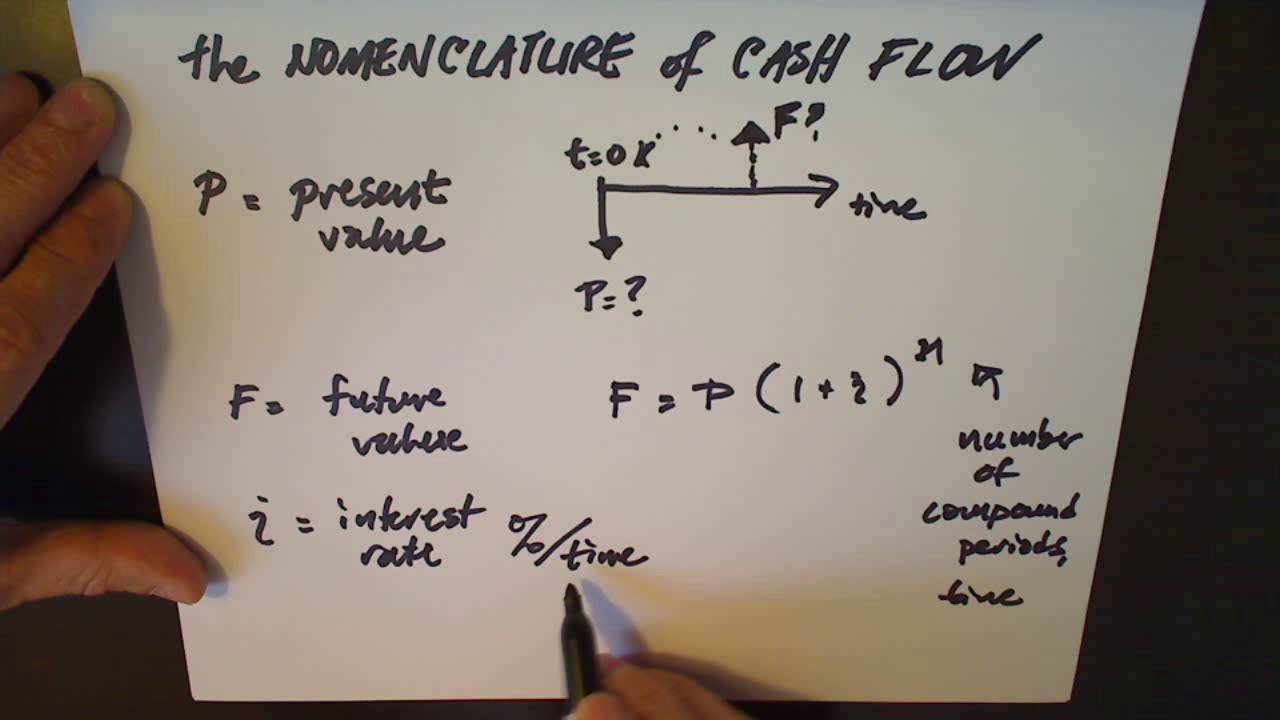

To calculate FCF get the value of operational cash flows from your companys financial statement. The Present Value of the cash flows can be calculated by multiplying each cash flow with a Discount Rate. Calculate the present value PV of a series of future cash flows.

The other cash flows will need to be discounted by the number of years associated with each cash flow. Business plan maker Palo Altos free online calculator is well-suited to help retail and manufacturing business owners experiment. Rationale for Graphic Representation Most business owners.

Simply complete each of the six sections and the. First input any cash inflow. It is a method of.

A calculator will give you a detailed report about the present value of your future cash flows. Our Cash Flow Diagram Generator is an excellent tool for displaying business financial results both numerically and visually. Both of these and a lot else besides can be updated with.

Palo Alto Software Cash Flow Calculator. Ad QuickBooks Financial Software. Ad Manage Cash Flows More Efficiently.

Rated the 1 Accounting Solution. It converts all the irregular payments into monthly equivalents so you can budget and know your free cash flow position with confidence. If you run out of available cash you run the risk of not being able to meet your current obligations such as your payroll accounts payable and loan payments.

Single Payment Present Worth. In corporate finance free cash flow FCF or free cash flow to firm FCFF can be calculated by taking operating cash flow and subtracting capital expenditures. F V n C F n 1 i n n.

F V n 0 N C F n 1 i n N n. Find powerful content for cash flow analysis calculator.

Cash Flow Diagrams Present Or Future Value Of Several Cash Flows Engineering Economics Youtube

Solved A Calculate The Irr For Each Of The Three Cash Flow Chegg Com

Hp 12c Financial Calculator Internal Rate Of Return Hp Customer Support

Understanding Cash Flow Diagrams Present And Future Value Youtube

Irr Internal Rate Of Return Double Entry Bookkeeping

How To Make A Cash Flow Chart Easy To Follow Steps

Calculation Of Internal Rate Of Return Using A Cash Flow Diagram Youtube

Ch6a Annual Cash Flow Analysis Part I Youtube

Npv Calculator Irr And Net Present Value Calculator For Excel

How To Make A Cash Flow Chart Easy To Follow Steps

Using A Cash Flow Diagram For Calculation Of Net Present Value Youtube